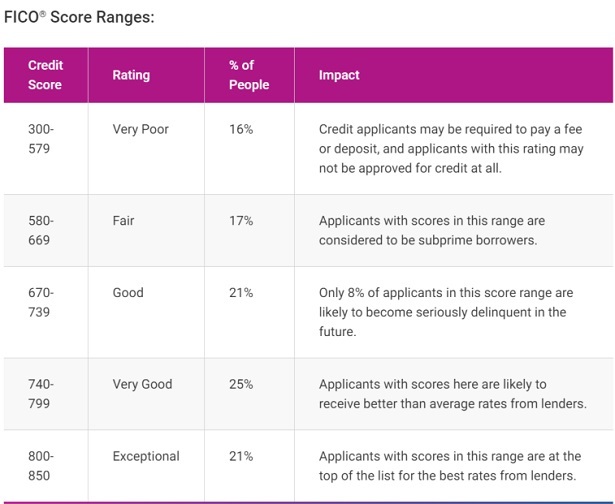

How Are Credit Scores Calculated?įirst, there are two primary credit score systems in the US: For that reason, everyone from credit card issuers and insurance companies, to mortgage lenders and property managers use FICO scores. By using FICO scores, lenders can quickly assess a consumer’s creditworthiness without poring over their entire credit profile. Creditors will then be aware of the risk they’re taking in lending to you.įICO credit scores range from 300 to 850. This indicates to lenders that you are a reliable borrower.īy the same token, if you have a history of late or missed payments, your credit score will be on the lower end. If you have a long history of on-time payments and you’ve been responsible with your credit, your credit score will be higher. This includes payments on credit cards, loans, and other bills. Your credit score takes into account various factors in your financial history and behavior. Lenders use your credit score to quickly evaluate how trustworthy you are when it comes to paying back a loan or credit card.Īlthough there are different types of credit score ratings, FICO is the biggest and most widely used credit scoring system. Your credit score is a three-digit number that represents your overall credit health.

However, if you’re still in the “bad” category, it will be difficult getting approved for a loan, credit card, or mortgage. It’s great to bump your score up by 100 points. That way, you can determine where yours should be to achieve your financial goals. When you’re attempting to improve your credit score, it’s important to know how lenders categorize credit scores.

0 kommentar(er)

0 kommentar(er)